Measure of Risk and Analytics Derivatives

Quantitative portfolio risk management often relies on statistical measures

related to the spread or the tails of the distribution of portfolio returns. Such

measures include variance and standard deviation (spread), coefficient of

variation (risk relative to mean), and percentiles of the distribution (tails).

Value-at-risk and conditional value-at-risk are the financial terms used to

describe two popular risk measures based on the percentiles of the distribution

of portfolio returns. Below we explain the statistical measures and their

corresponding portfolio risk measures in more detail.

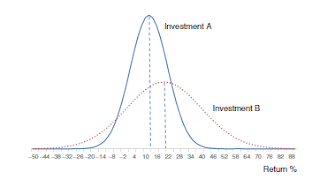

Variance and Standard Deviation When thinking of risk, one usually

thinks of how far the actual realization of an uncertain variable will

fall from what one expects. Therefore, a natural way to define a measure

of uncertainty is as the average spread or dispersion of a distribution. Two

measures that describe the spread of the distribution are variance and standard

deviation. The two are strongly related: the standard deviation is the

square root of the variance, and we usually need to compute the variance

before computing the standard deviation. Exhibit 2.9 illustrates the relationship

between variance/standard deviation and the spread of the distribution.

Suppose we are considering investing in two assets, A and B.

Coefficient of Variation Let us consider again the picture in

Exhibit 2.9. We mentioned that the probability distribution for A has

a smaller standard deviation than the probability distribution for B, but

notice also that the mean of the distribution for A is lower than the mean for

the distribution for B. If you had to invest in one of them, which one would

you choose? This is a situation in which one may want to measure spread

(the “risk” of the distribution) relative to the mean (the “representative”

value of the distribution). This is the concept behind coefficient of variation

(CV), which is reported as a percentage, and is mathematically expressed as

CV = 𝜎

𝜇

× 100

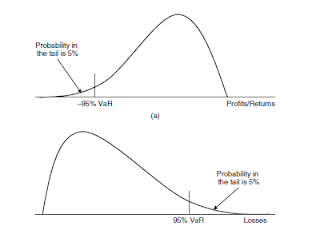

Value-at-Risk Value-at-risk (VaR) is related to the statistical

measure percentile. VaR measures the predicted maximum portfolio dollar

loss at a specified probability level over a certain time horizon. Commonly

used probability levels include 0.95 and 0.99, and the corresponding VaR

is referred to as 95% VaR and 99% VaR (in other words, the probability is

stated as a percentage). Typical time horizons include 1 day and 10 days.

The portfolio loss is defined as the difference between the initial value of

the portfolio at the current time t, Vt, and the future value of the portfolio

at time t + 1, Vt+1.4

Quantitative portfolio risk management often relies on statistical measures

related to the spread or the tails of the distribution of portfolio returns. Such

measures include variance and standard deviation (spread), coefficient of

variation (risk relative to mean), and percentiles of the distribution (tails).

Value-at-risk and conditional value-at-risk are the financial terms used to

describe two popular risk measures based on the percentiles of the distribution

of portfolio returns. Below we explain the statistical measures and their

corresponding portfolio risk measures in more detail.

Variance and Standard Deviation When thinking of risk, one usually

thinks of how far the actual realization of an uncertain variable will

fall from what one expects. Therefore, a natural way to define a measure

of uncertainty is as the average spread or dispersion of a distribution. Two

measures that describe the spread of the distribution are variance and standard

deviation. The two are strongly related: the standard deviation is the

square root of the variance, and we usually need to compute the variance

before computing the standard deviation. Exhibit 2.9 illustrates the relationship

between variance/standard deviation and the spread of the distribution.

Suppose we are considering investing in two assets, A and B.

Coefficient of Variation Let us consider again the picture in

Exhibit 2.9. We mentioned that the probability distribution for A has

a smaller standard deviation than the probability distribution for B, but

notice also that the mean of the distribution for A is lower than the mean for

the distribution for B. If you had to invest in one of them, which one would

you choose? This is a situation in which one may want to measure spread

(the “risk” of the distribution) relative to the mean (the “representative”

value of the distribution). This is the concept behind coefficient of variation

(CV), which is reported as a percentage, and is mathematically expressed as

CV = 𝜎

𝜇

× 100

Value-at-Risk Value-at-risk (VaR) is related to the statistical

measure percentile. VaR measures the predicted maximum portfolio dollar

loss at a specified probability level over a certain time horizon. Commonly

used probability levels include 0.95 and 0.99, and the corresponding VaR

is referred to as 95% VaR and 99% VaR (in other words, the probability is

stated as a percentage). Typical time horizons include 1 day and 10 days.

The portfolio loss is defined as the difference between the initial value of

the portfolio at the current time t, Vt, and the future value of the portfolio

at time t + 1, Vt+1.4

No comments:

Post a Comment